Was your home damaged by Hurricane Ian?

Find out how we can help you

Home values are at an all-time high which means it is likely that you have built up equity in your home. If you want to turn your home equity into actual money you can use, then a cash-out refinance is a great option. RP Funding has paid over $80 million in Closing Costs for consumers just like you. Apply today to find out if you qualify for one of our Closing Cost programs.

Consolidating high-interest debt, such as credit card debts, student loans and personal loans is a good use of a cash-out refinance. Currently, credit card interest rates are about four times higher than mortgage interest rates. This could make for significant savings. You may also receive tax benefits on mortgage interest, which is not often true about credit card and personal loan interest.

You can also use the cash for major purchases or unexpected expenses where financing may not be available or have higher interest rates. Some other common uses are: home improvements (which could increase your equity even more!), educational expenses, and investments.

Credit Card Debt

Student Loans

Medical Debt

Ultimately, everyone’s financial situation is unique and at RP Funding we have licensed professionals who can assist you in determining if a cash-out refinance is a good option for you and help you save thousands in Closing Costs.

A cash-out refinance lets you refinance your current mortgage, borrow more than you currently owe and keep the difference (home equity) as cash. It could be a great way to unlock your hard-earned equity and get the cash you need.

Your home is worth:

Your current mortgage is:

With a refinance, you could cash-out a portion of this equity. If you wanted to take out $60,000 in cash, your new mortgage principal amount would be the current balance of $200,000 plus $60,000 totaling $260,000.

*Illustration does not reflect actual cash values and does not include closing costs, escrows, prepaids, or elected expenses.

If you owe less than your home is worth, you have equity and you may be eligible for a cash-out refinance. Since you already own the home, refinancing will be a smooth and painless process.

The process for a cash-out refinance is simple. Complete a basic loan application, get an appraisal to determine your home value (and equity), sign the paperwork to make your new home loan official, and four business days later you will receive a check for funds requested.

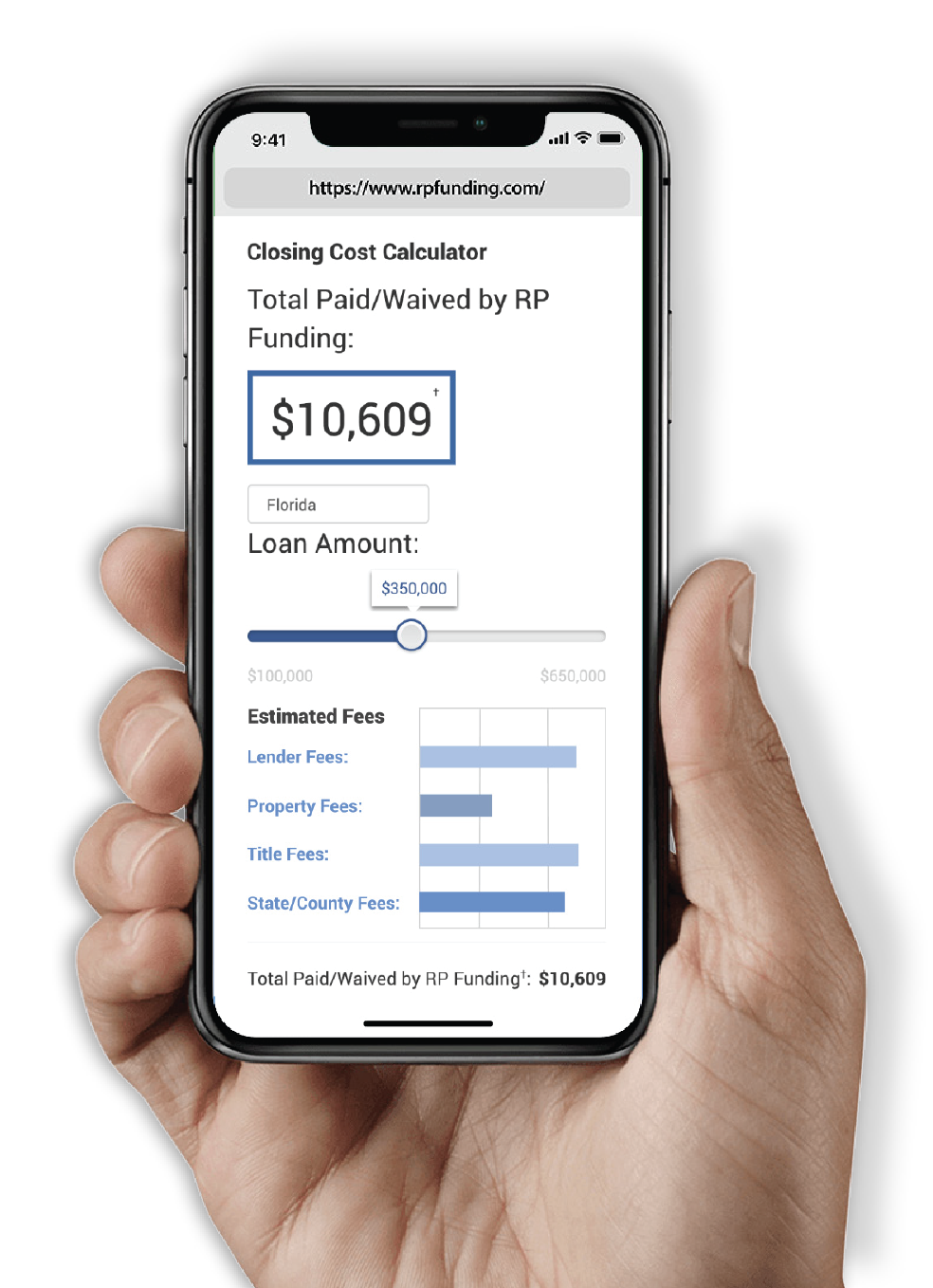

The No Closing Cost Refinance was created to get you more cash at closing and help you make the most of your home equity.

Other lenders may fold your Closing Costs into your loan financing instead of actually paying the Closing Costs for you like RP Funding does. This ultimately reduces the hard-earned home equity that you are able to access and costs you more money over the life of the loan.

RP Funding offers Closing Cost Programs to well-qualified homeowners.

Our dedicated team of mortgage experts will make sure the entire process is easy, painless and on-time.

$1,000 Mortgage Challenge: If you find a better deal somewhere else we will beat their deal or pay you $1,000.

At RP Funding, we handle every step of the process in-house resulting in superior customer service.